Analysis of industry data by Colibri Aircraft, a private jet broker, reveals that the number of business aircraft departures in Europe in July was 54.5% higher than June, as the sector continues to make a solid recovery.

Indeed, the number of European business aircraft departures in July was only down around 12% on the same month last year and August is equal when compared to 2019, whereas commercial flights in the continent were over 50% lower.

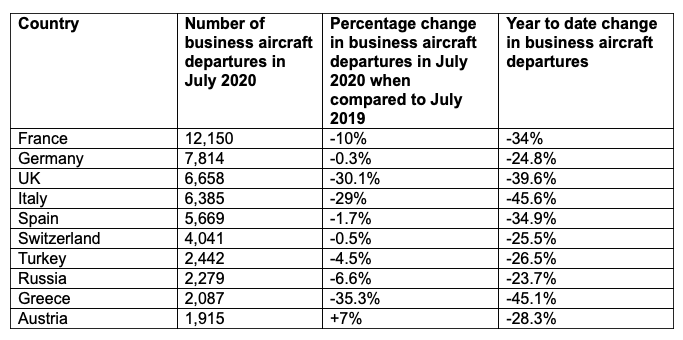

Of the top 10 largest European markets for business aviation, Austria, Germany, and Switzerland are leading the way in terms of a recovery. In July, Austria saw a 7% increase in business aircraft departures when compared to the same month last year, and the corresponding figures for Germany and Switzerland are -0.3% and -0.5% respectively.

Greece, the UK and Italy have seen the slowest recovery in business aircraft departures during the COVID-19 crisis.

For Europe as a whole, there were 67,456 business aircraft departures in July, down 11.9% on July 2019. However, this is a huge improvement compared to June, where the corresponding figures are 43,659 and -40.7% respectively.

Oliver Stone, Managing Director, Colibri Aircraft said: “The business aviation market is recovering much faster than the commercial sector primarily because the latter is offering far less flights and routes, and there is a reluctance from many people to fly in a crowded space with 200+ other passengers. Private Aviation provides a convenient and reliable solution to both problems. Our business is buying and selling aircraft for clients and we have seen a significant increase in interest in light jets, perfect for getting around Europe with two to six passengers. This is driven by business people who need to travel and cannot do so with cancelled airline routes, and by families who are reluctant to risk exposure to further virus outbreaks. For many users of private jets, owning and using a plane is the only way to continue to operate their businesses in this historic time of minimal airline routes. On a geographical basis, the European business aviation market is also recovering faster than the north American market – by the far the biggest in the world – which saw a 21.4% decline in the number of business aircraft departures last month when compared to July 2019.Finally, in terms of business aviation in Europe, we should not lose sight of the fact that the sector employs around 335,750 people directly and indirectly, and the value of its economic output is around €71 billion a year.”