By Richard Koe

The business aviation industry in 2023 appeared to exit the turbulence created by the pandemic, the surge in flight demand tapering off record peaks, pre-owned transactions becalmed, whilst order books for new aircraft have extended out several years. The question on the agenda in January 2024 is whether this year we will see further deflation in utilization, as a leading indicator of broader demand. Much depends on whether the newcomers to the industry during covid are staying in large number, or whether, conversely, the bleak economic outlook will create a shake out.

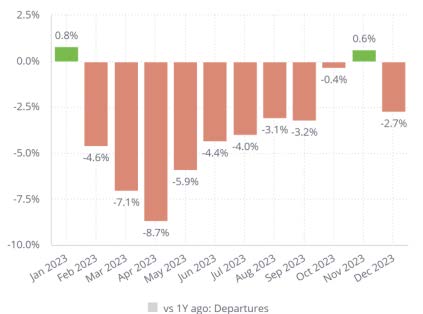

Business jet departures in 2023 compared to 2022

Retrospectively, it seems logical that an untapped market of potential business jet users would start flying private once the lockdown lifted, with health issues paramount and convenience trumping cost as the airlines grounded their fleets. But at the time, the pace of the upswing in business jet activity confounded many. Suppliers were caught on the hop. As demand overwhelmed supply, prices surged. The market was bound to restabilize but it wasn´t clear when that would happen. Few could have forecast the Ukraine war in early 2022, which took the wind out of the European bizav market.

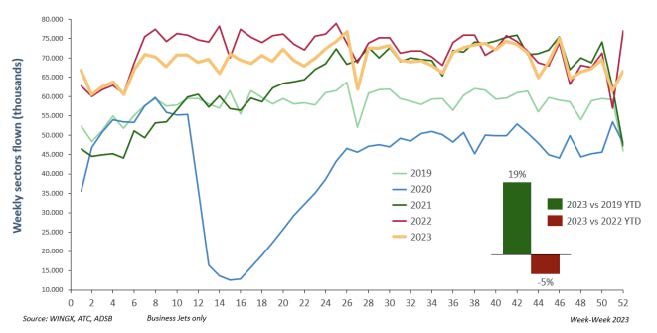

From March 2022, business jet activity peaking 30% higher than previous records, demand started to subside. Geopolitical crisis in Europe removed the significant Russian charter market. The supply chain repercussions of the invasion were global, led to runaway inflation and forced central banks to ratchet up interest rates. From mid-2022 economic recession loomed across the major bizav markets in the US and Europe. Other positive industry indicators like preowned transactions bounced off historic peaks and started to fade by the end of the year. Demand for new aircraft showed up in swelling order books but production lines slowed as global supply chains distorted. Twelve months ago, forecasting 2023 looked like a surer bet. Bizjet demand was bound to deflate further as the economy wobbled and inflation bit. The regional banking crisis back in March 2023 was a prime example, showcasing the impact of the interest hikes. A moderate slowdown in flight demand threatened to become an industry relapse, but by the summer, demand in the US had stabilised just a couple of points below 2022. A steady overall trend in flights, close to 20% above 2019 levels, belied some significant geographical variances. Florida maintained its status as the post-Covid hub for bizjet travellers, whereas California ebbed as its economic fortunes deteriorated.

Global business jet activity in 2023 compared to previous years

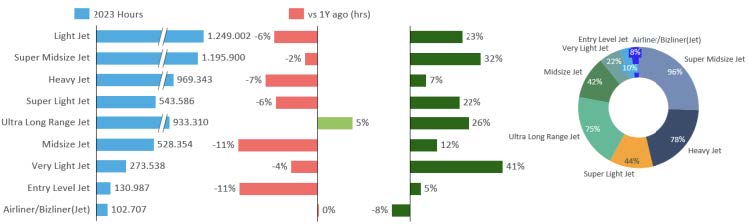

The weak spot in utilisation last year was charter, especially in the entry-level space opened up by the surge of newcomers during Covid. Wheels Up felt the pain, with its overextended service coverage seeing yawning losses in its financial results by the second half of 2023. This softness in the market was also reflected in smaller aircraft flying less. The heights of the charter boom in 2022 had dragged older fleets back into high frequency service. By mid- 2023, these platforms were seeing activity levels fall back to 2019 levels. Wheels Up was rescued by Delta Air Lines back in September. Another significant operator of small jets, Jet It, closed its doors altogether in May.

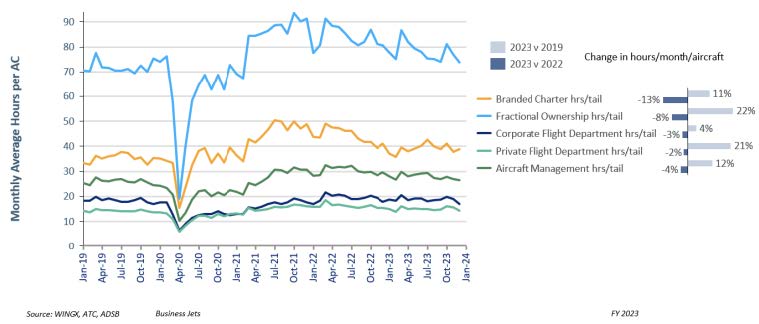

Business jet utilisation by operator type (2019-2023)

The charter slowdown was not restricted to the lightest end of the market. Global charter program provider Vista Jet had grown rapidly during the pandemic, needing multiple acquisitions of competing operators to meet rampant demand for large long-range aircraft. But when the market wobbled in early 2023 questions were asked around the sustainability of high operating costs and softening overall demand. As it turned out, Vista´s fleet mix was well suited to the variable demand for different business jet segments in 2023; light and heavy jets are flying much less than before, but super midsize and ultra-long range jets continued to see strong demand compared to 2019.

The environment for business operators has been tougher in Europe. The EU´s economies were stagnant before the Ukraine war, already engulfed in inflation and debt from the lockdown. The Ukraine war fuelled inflation and exposed the Union´s energy insecurity, especially in Germany. Ironically the energy crisis has coincided with a post-Covid surge in climate activism around fossil fuel production. The use of business jets has fallen into the spotlight as exhibit A for extravagant pollution. Right across the continent, 2023 saw a surge in incidents of disruption and sabotage at business aviation events, conferences and expos. It´s difficult not to see a connection to the dwindling rates of corporate flight activity in Europe, now well below 2019 levels. Corporate flight department activity has also waned in the US. The inertia of digital working stalled the recovery of business travel in the pandemic´s aftermath, but in terms of new aircraft orders, corporate interest has been very strong according to the broker community. More likely, corporate users have been switching out of dedicated flight departments into fractional and managed programs. This partly explains the growth of leading aircraft management companies and fractional operators. In particular, 2023 was a stellar year for the fractional business, seeing new heights in flight activity and taking record-breaking options on new aircraft.

Business jet demand by segment (2023 vs previous years)

The sustained demand for larger long-range aircraft has underlined the growing importance of geographic markets outside the US and Europe. The Middle East, and the Gulf States in particular have seen a dramatic increase in business aviation since 2019. As in the US, demand was galvanised by Covid, but also has growing momentum from the broader government-backed investment programs in the region, not least in Saudi Arabia. The World Cup in Qatar in 2022 was a pinnacle, but also just one of a multitude of investments in sports and entertainment by Gulf States eager to cash in on global tourism. Geopolitically the region was heading in the right direction, until October 2023.

Geopolitics has traditionally been an outrider for business aviation demand, setting the bounds of growth within each industry cycle. In recent years, geopolitical considerations are no longer peripheral considerations. Whether the users of business aviation work in energy, tech or finance markets, the geopolitical situation is now setting the agenda. Seemingly dispersed crises in Ukraine, Israel and Taiwan have joined up to spell out a narrative of the West under siege. The unipolar world in which business aviation incubated is now breaking up. The globalisation of trade and commerce, a locomotive for business travel since the 1990s, is coming off the tracks. It´s difficult not to see this as a headwind for the industry in the years ahead.

The flipside to the argument is that the risk and uncertainty of a geopolitically turbulent world may encourage people to use business aviation when they travel. Scheduled airlines may have largely recovered their capacity from pre-Covid, but airline service quality has been riven by strikes, staff shortages and logistics issues. On a broader canvas, the multipolar world emerging from the West’s globalization is galvanising new trading relationships. Globally-capable business jet operators and suppliers are benefitting from the growth of strategic hubs such as the Middle-East, and more broadly the closer collaboration of countries across the global south.

Coming back to the numbers, we expect to see a modest increase in flight activity this year compared to 2023. This would reverse the decline we saw last year, and would move the market back towards the record activity in 2022. Some growth in utilisation would endorse the tenor of customer surveys, including Jetnet’s own IQ. Resilient demand for business jets would also reflect a slightly improved though still-fragile economic climate. Business jet activity will benefit from growth in aircraft deliveries, particularly the large jets flying longer sectors, notably the G700 and Falcon 6X. The bias of deliveries towards fractional operations will also bolster growth.

Positive momentum will nonetheless be tempered by the prevailing headwinds – weakening consumption demand, especially in Europe, the distraction of elections, notably in the US, the ever-growing challenge of the sector’s poor environmental profile, the ongoing kinks in global supply chains – these will limit any growth to a few percentage points. There may be upside risks, with inflation coming swiftly under control, or, perish the thought, a smooth presidential transition. The downside risk list is much longer. Geopolitical risk, and specifically the outbreak or escalation of regonal conflicts, is worryingly near the top of that list. Fingers crossed for a smooth climb.