By Richard Koe

As we come through the first quarter of 2023, the business aviation industry is getting buffeted as expected by headwinds from the slowing global economy. As the pandemic recedes in the rear-view mirror, the surge in business jet demand from mid-2021 through mid-2022 now appears more of a one-off bounce. The record-levels may in the future be seen as a one-off anomaly in a similar way to the peak business jet deliveries back in 2008. Deliveries last year weren’t within 40% of that peak and aren’t expected to regain those levels until the latter half of this decade.

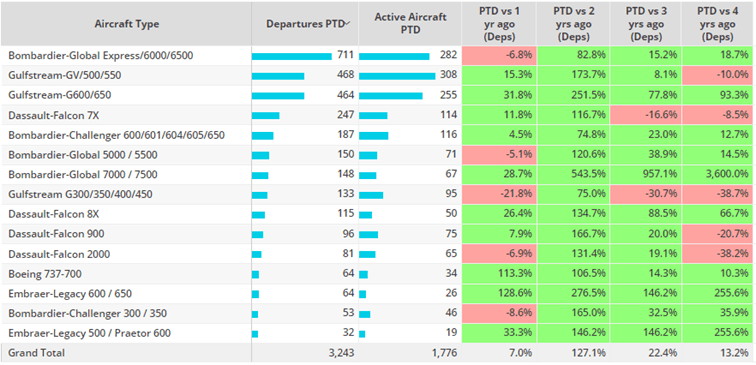

But the outlook for business aviation as the economy slows in 2023 is not as severe as it was 15 years ago. Business jet usage has been faltering since the middle of last year, and the slide has accelerated since February, but the market has retained much of its gains from the pandemic period. Business jet and turboprop activity in the first quarter of 2023 is only 2% off where it was in Q1 last year, and retains a 12% lead on comparable pre-Covid 2019, equivalent to 140,000 additional flights over three months. More broadly, industry indicators remain fairly strong: pre- owned inventory is relatively scarce; prices are holding up; OEM order books are well stocked.

Global business jet flights week-week in Q12023 versus previous years

There are however warning signs in the deterioration of sentiment surveys within the industry. From the low points of early 2020, scores generally hit record highs but have since come back to a somewhat negative outlook for the next 12 months. Specifically, the bi- monthly Barclays Business Jet survey is tracking a 50% deterioration in sentiment since October 2021. Typically-cited misgivings include the spill-overs from geopolitical tensions and the febrility of financial markets in the wake of rapid interest rate hikes. With the collapse of Silicon Valley Bank, the underlying risks of much tighter financial conditions are now manifest, and yet persistent inflation is far from under control.

Business jet owners may be relatively insulated from the macroeconomic instability but are certainly exposed to changes in tax and regulation. The reduction in bonus depreciation from 2022 may have cooled new aircraft demand. Wealth taxes are likely to emerge in various forms as economies hit the buffers. Corporate flight departments will be wary of poor shareholder optics, particularly as sustainability scrutiny is intensified. Notwithstanding its awareness of ESG issues, the bizjet industry still seems wrong-footed on this topic. The media is all too willing to promote the activists distorted view of industry emissions. In Europe at least, policy appears to be shifting towards direct regulatory limitations on private jet movements.

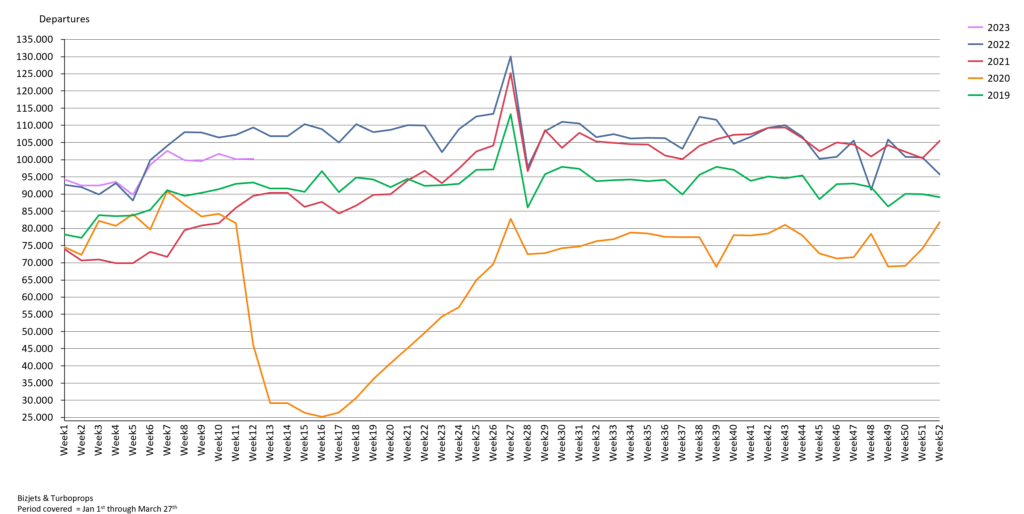

Comparing Q1 23 with Q1 19, business jet flights in Europe are higher by only 5%, a meager 1.2% compound annual growth rate. Compared to Q1 last year, activity has slumped in the four largest markets representing 40% of all regional flights. Not all European countries have seen declines, with bizjet movements in Turkey and Italy still at record levels. The collapse of the Russian market has certainly subdued activity; at the outset of 2022, Russia ranked among the top 5 busiest markets in Europe, now trails pre-pandemic flying by 60%.

Business jet activity across different European countries in Q12023

A major driver for business jet usage in the last two years has been the erosion in frequency and reliability of scheduled airline services. Even three years after the airlines were grounded for lockdown, the recovery in network services is eroded. Airline sectors in Europe are still trailing pre-Covid levels by 15%. The inconvenience for the traveler has been compounded by the net reduction in uniquely served pairs over the last two years. Short- staffed and racked by strike action, the bad experience of flying scheduled has no doubt kept many private jet newcomers loyal despite the multi-fold difference in ticket price.

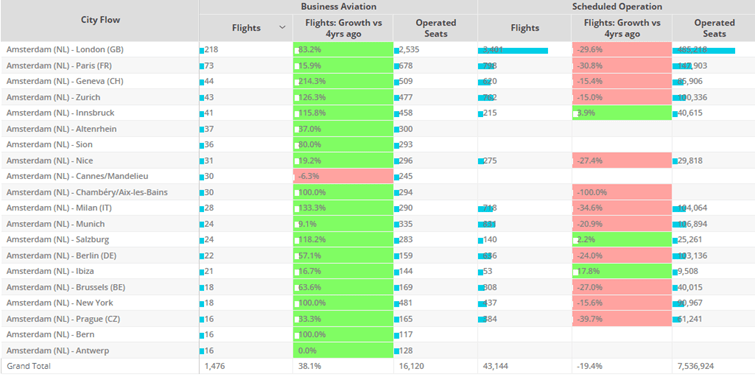

A case in point is Schiphol airport in Amsterdam, where private jets have recently been the target of sabotage by climate protesters, with the airport indicating its intent to ban private flights in the future. Schiphol has indeed seen very strong growth in private jet usage in the last 2 years, departures up 38% compared to 4 years ago. Comparing the same periods, airline flights out of Schiphol have declined by 18%. The most demanded business jet connection, between Schiphol and London airports, has seen an increase of 83% compared to Q1 2019. The correlation clearly suggests that diminished schedules have pushed many travelers to fly private; they won’t be happy to lose the alternative option.

Business jets vs Scheduled airlines, Amsterdam Schiphol airport Q1 2023

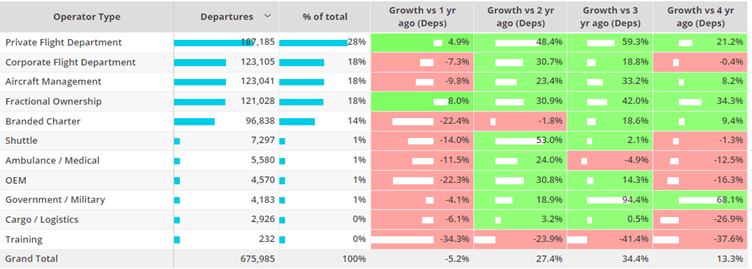

North America, accounting for 76% of all business jet flights worldwide, has seen a milder slowdown than Europe in activity so far this year, 5% fewer flights than in Q1 2022, and retaining a more substantial lead on pre-Covid 2019. Whereas February 2022 saw the end of the Omicron wave and a massive surge in travel, taking activity to it’s all-time peak, this year has seen some recovery in airline services, and clearly some budget reservations on behalf of new private flyers as their paper-wealth gets a significant downwards revision in the stock market. The charter market has taken the brunt of the slowdown, with dedicated “branded” charter activity down 22% in Q1 23 compared to Q1 22.

North American bizjet flights by operator type, Q1 2023 compared to previous years

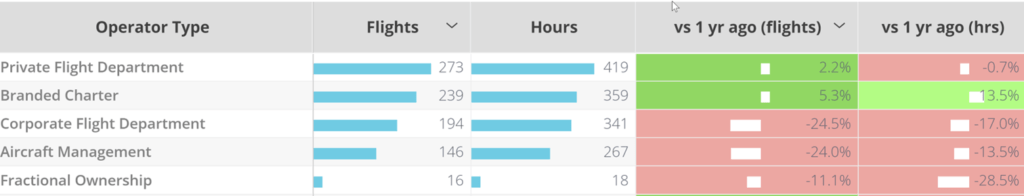

The more resilient commercial category is Fractional, which appears to have gained customers from those wanting the predictable costs and larger fleet operators accessible within these programs. These operators may also be gaining customers who have sold aircraft and are now waiting on log-jammed OEM production lines, or those simply wanting to move on from the potentially risky optics of full aircraft ownership. This is likely a pressure felt by corporate flight departments, which have seen no overall recovery in flying versus 2019. This pressure will intensify if we see further banking crises. Silicon Valley Bank collapsed in March and it’s no surprise that nearby Hayward Executive Airport has seen a sharp decline in corporate flight department activity compared to last year.

Business aviation activity from Hayward Executive Airport in Q1 2023

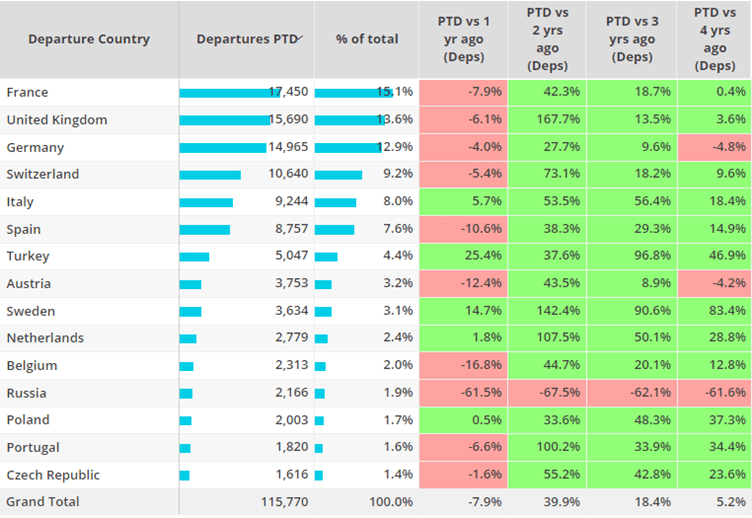

Despite the headwinds on corporate flying and the clear erosion on entry-level business jet charter customers, there are still indicators of strong performance in the US business jet market. Combining all P135/91k activity, flights are down 11% in Q1 2023 compared to last year, but still 37% above where they were in 2019. Light Jet activity has come well off its peak but Super Midsize, Ultra-Long-Range Jets and Very Light Jets are still flying at record levels. Long-sector connections are still in a recovery period, with Trans-Atlantic bizjet sectors (North America – Europe), up 7% in Q1 compared to Q1 2022, 13% above Q1 2019.

Trans-Atlantic Business Jet Aircraft Types, Q1 2023 compared to previous years

Business jet activity outside North America and Europe accounts for a relatively small share of worldwide sectors, around 10% in Q1 2023. Across these “rest-of-the-world” regions, the growth in business jet activity has continued unabated since the new year. Q1 2023 has seen a 20% increase in sectors flown compared to Q1 2019, up by 77% compared to Q1 2019. Brazil was the busiest market in Q1, 17% ahead of last year, double the activity of Q1 2019. The effect of the release of prolonged lockdowns in China is evident in a 30% rebound versus last year, but flights are still down by 5% compared to 2019. Beijing Capital is the busiest departure point in China, departures up 23% compared to last year, although 44% below 2019. Ultra-long- range jets are the busiest aircraft segment, flights up 28% compared to last year, although lagging 26% behind 2019.

The Middle East has been a magnet for business aviation activity since the outbreak of the pandemic, with 13% increase in flights in 2022 compared to 2019 and a further 11% growth in 2023 compared to Q1 2022. As the region becomes an increasingly important geopolitical “swing state” and with oil prices significantly recovered from the pandemic, the growth in flight activity looks very sustainable. A raft of mega infrastructure projects is scheduled to provide a huge increase in tourism, with the region already seeing a big shift in foreign direct investment from Russia and China as their relations sour with the West. To the extent that the UAE and Saudi Arabia remain relatively neutral to all-comers, business aviation operators, suppliers and maintenance providers will be looking to join the bandwagon.

The Middle East could also be one of the hubs for Advanced Air Mobility (AAM) with the emergence of multiple test platforms, most recently VPorts strategic operator investments in Dubai. The AAM sector has long been positioned as a new branch of business aviation, not just in providing last mile connectivity but also pioneering the adoption of zero emission engine technology. The path to commercial viability of AAM operations more generally has hit serious headwinds as the global economy stutters, but the latter half of this decade should prove out the size of its new market. That may come just in time for the core business jet industry looking to renew its order books into the next growth cycle.