By Richard Koe – ©WingX

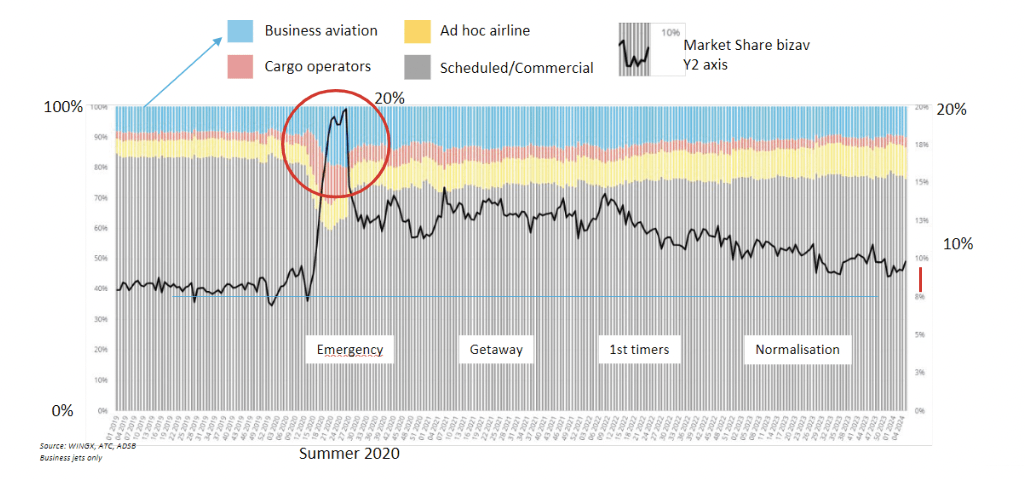

Global business jet activity currently represents around 10% of all fixed wing flight activity globally, down from almost 20% of all flights operated at the height of the pandemic in Summer 2020. As shown, the pre-pandemic share for business jets was closer to 8%. The normalisation of business jet demand has been evident since business jet activity came off its peak in late 2023. Underlying the rebalancing of demand across bizjet and commercial is a shift in some passengers from flying private during the pandemic, back to the belatedly recovering airline sector.

Global business jet activity in the context of all fixed wing activity

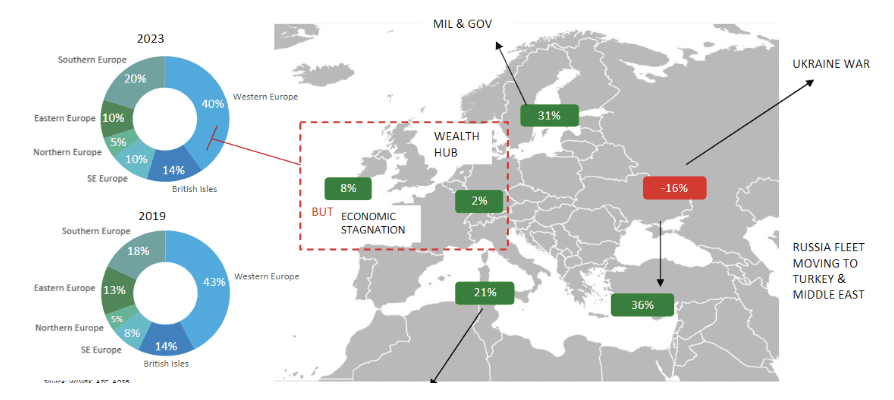

In Europe, the share of business aviation activity is somewhat smaller than in the dominant US market. The bounce in business aviation activity during the pandemic period was also relatively smaller, diminished by the economic headwinds which followed the outbreak of war in Ukraine in 2022. The regional pattern is far from homogenous, with stark contrast in business jet growth in 2023 compared to 2019, as shown in Chart 2 below. Western Europe carries over 40% of all business jet flights. Within this region, the UK saw a much stronger recovery than Central Europe, flights up by 8% over the 3 years compared to just 2% across core markets such as France and Germany.

Growth in business jet activity between 2019 and 2023

The share of European bizjet activity originating in Southern Europe, principally Italy and Spain, has increased from 18% to 20% over the 3 years, with flights growing 21%. This appears to underline a strong and resilient growth in high-end tourism, with many of the busiest hubs, such as Olbia, Barcelona, Majorca, Ibiza, well known top-tier leisure destinations. Greece and Turkey have also seen a lot of growth since 2019, partly due to holiday demand, also reflecting the shift in aircraft re-basing from Russia, following the sanctions imposed in 2022. Bizjet flight activity out of Russia is down by two thirds since 2022, and overall, Eastern Europe and Russia combined has seen a 16% drop between 2022 and 2023.

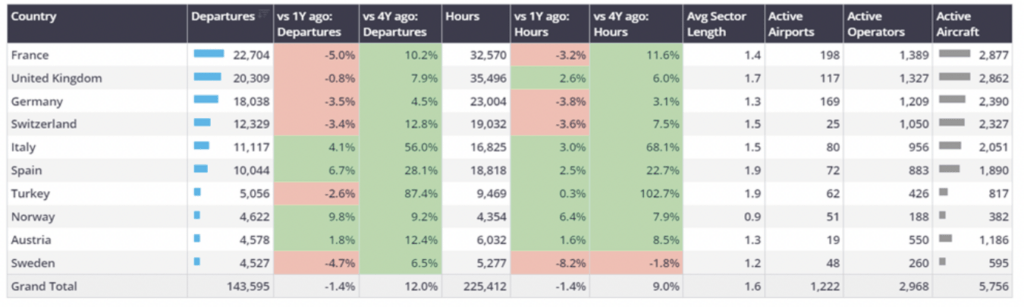

So far this year, business jet departures and flown hours are both up by just over 1% compared to the first 3 months of 2023. The regional divergences are clear, with France, Germany, Switzerland seeing considerably weaker performance than last year, whereas Italy and Spain are well ahead. Business aviation activity in Norway is notably up, maintaining a strong growth trend since 2019. This appears to reflect increased government and military use of business aviation aircraft. Italy stands out, with activity up 68% compared to Q1 2020, noting that the pandemic restrictions were already denting travel demand by late March 2020.

European bizjet activity by country for Jan through Mar 2024

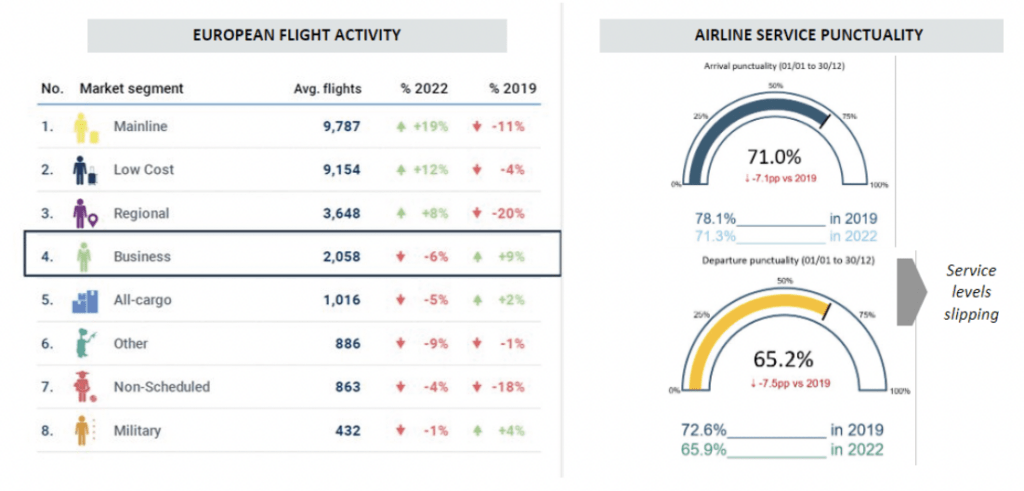

The wider context for explaining trends in business aviation is the trend in flight activity across all sectors. According to Eurocontrol, average flights per week on business aviation aircraft in Europe were up by 9% in 2023 versus 2019, making it by some way the strongest aviation sector. Indeed, compared to 2019, the primary airline sectors were all still down, even low-cost, down by 4%, and notably the regional airlines, flying 20% less. Cargo is slightly up but less impressive than business aviation. The resilience of business aviation demand is understandable from the erosion in airline punctuality compared to 2019, with no recovery last year. It wouldn’t be surprising that many first time bizjet users during the pandemic are still flying private in 2024.

Mix of European flight activity, and reliability of commercial airline services

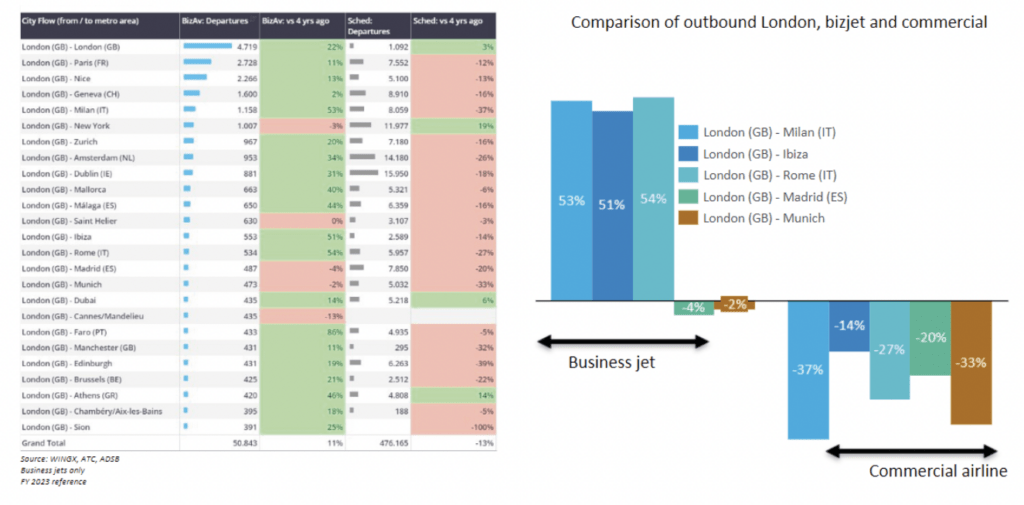

Evidence of an inverse correlation of business jet demand and airline activity from major metro hubs in Europe backs up the likely shift in passengers from commercial to private. Taking London as an example, as shown in Chart 5, bizjet outbound flights were up 11% compared to 2019, in contrast to scheduled flights, down by 13%. Some of the contrasts are stark, for example, bizjet traffic from London airports to Milan, Ibiza, and Rome is up by more than 50%, whereas the same routes are respectively down 17%, 14%, and 27% for commercial airline sectors. Notably, bizjet traffic between London airports is up by 22%; these would include repositioning, maintenance and demo flights.

Business jet and Commercial airline outbound from London in 2023

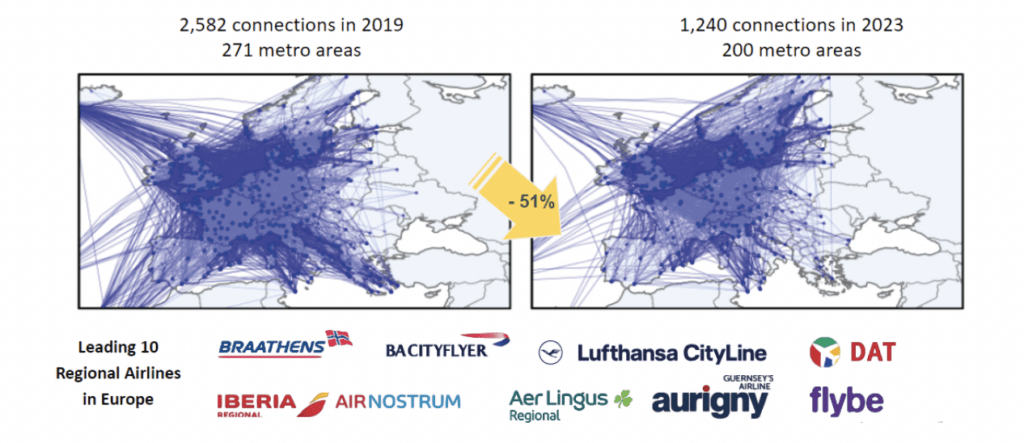

Regional airlines in Europe have seen the most marked deterioration in connectivity in Europe over the last few years. As shown in Chart 6, back in 2019 the leading 10 regional airlines in Europe connected 271 metro areas (population exceeding 100,000), with 2582 unique pairs. In 2023, the same airlines connected 200 metro areas, with just 1240 unique pairs, an erosion of 51%. The average sector length is evidently longer, with an average of 500K to close to 800KM, signaling the engagement of larger aircraft connected a consolidated spectrum of metro airports. Small airports have been progressively abandoned by scheduled services.

Regional airline connections

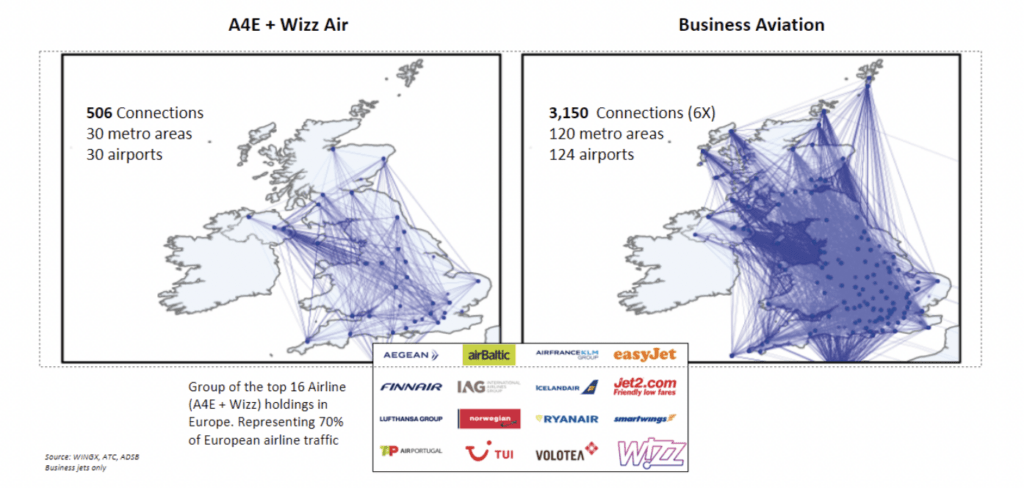

The same contrast is evident across the wider airline platform, as shown in Chart 7, where the leading airline operators (A4E and Wizz Air) covered barely one tenth the connections served by business jets in 2023. Whilst airlines, including the leading Low Cost Carriers, connected 30 metro hubs, business jet sectors connected 124 airports, linking up 120 metro areas. Coverage is extended still further if we include turboprops, pistons and helicopters. Across leisure, business, logistics, government, and medical missions, it’s very clear that the broader definition of general aviation goes well beyond the connectivity offered by scheduled services.

Commercial and Business aviation coverage in the UK in 2023

The tremendous advantages, and associated economic benefits, of the connectivity provided by business aviation are generally put in the shade of the sector’s eye-catching carbon footprint. At the aggregate level, the bizav footprint is only conspicuous for its tiny share of all transportation emissions, but at the per passenger level, the impact is obviously high. Pressure groups and policy makers have successfully lobbied for airlines to restrict domestic schedules which can be served by rail. Legislation has passed in France and Spain which has effectively cancelled a handful of airline connections.

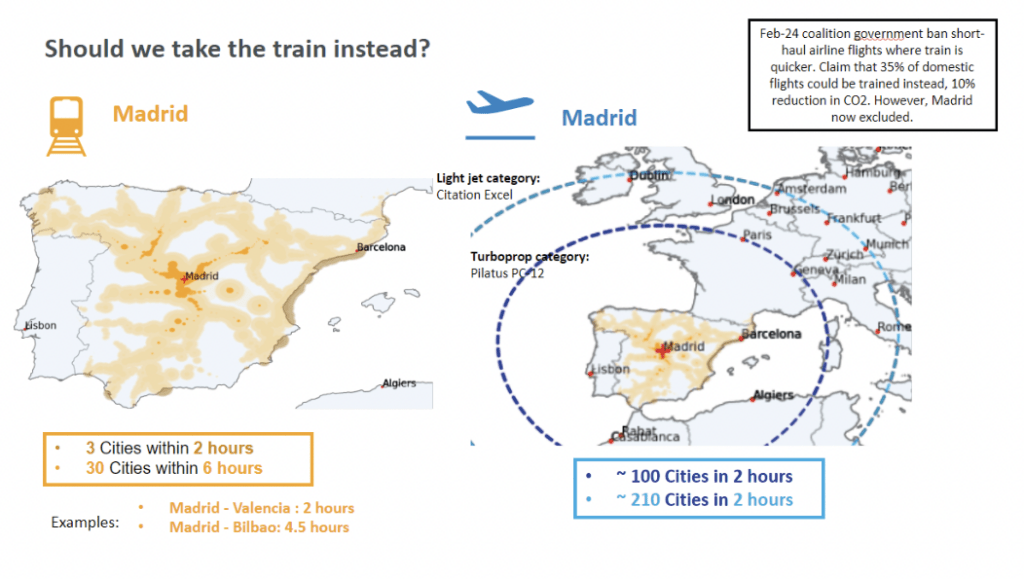

Whilst the replacement of short-haul trips by aircraft by low-emission train sounds plausible, the two-to-three hour threshold is insufficient for anything close to the coverage enabled by general aviation. As shown in chart 8, the extent of 2-hour train journeys from Madrid connects only three cities. Valencia has been promoted as the exemplary fast-train connection but most other major domestic cities are out of reach; it takes 6 hours by train to reach 30 cities. By contrast, a PC-12 departure from Adolfo Suárez Madrid-Barajas would reach Paris inside 2 hours, one of 100 cities available.

Connectivity by rail vs aircraft

As the business aviation industry approaches the mid-point of 2024, straining into the headwinds of a stagnating economy and a growing critique from the climate lobby, the connectivity arguments need emphasis more than ever. The connectivity advantages need to be linked to the economic and other enabling benefits of completing return journeys in a matter of hours rather than days. The trajectory of policy-making towards aiming to restrict and tax business aviation is clear. The industry has some strong arguments to make and needs to make them soon.