By Richard Koe – © WingX

At the World Economic Forum in January this year, there was broad consensus that the US economy was set for resurgent growth, unleashed by the Trump 2.0 focus on on cost-cutting and deregulation. Equity markets were expected to break new records and cooling interest rates spur a renaissance in US mergers and acquisitions. All this looked like good news for the business aviation industry, already humming along nicely in terms of growing flight activity and multi-year order books. Less than 3 months later, following Liberation Day and the imposition of world-wide tariffs on US trade, JP Morgan shifted its expectation of economic recession in the next 12 months to 60% likelihood.

Even with most industry signals looking positive, the most regularly cited concern for bizjet suppliers in the last 3 years has been supply chain. The amplitude and specificity of aircraft components and parts, and the mobility of business jet assets, operators and owners, have long since burdened the aerospace sector with complicated supply chains. Hugely distorted by the Covid lockdowns, and further discombobulated by the Ukraine war, the industry’s supply chains have buckled since 2020. The pandemic triggered a new wave of business jet demand which OEMs have consistently struggled to service. Even after 5 years’ recovery, the OEMs are struggling to match pre-Covid delivery numbers.

Hopes were that this year the supply chain problems would dissipate as manufacturers and suppliers worked out the kinks. Whilst it was well known that tariffs were on Trump’s agenda, few expected the speed and extent of their enactment. Now the potential scale of the disruption to trade is becoming ominously apparent, with US tariff barriers significantly exceeding the historic peaks of Smoot-Hawley back in the 1930s, hardly an auspicious era to hark back on.

Overall tariffs on China are well over 30% (and that’s before retaliation), but for many observers the most alarming tariffs are those targeted towards close US allies, Mexico, Canada, UK and the European Union.

Within the bizav industry, the most obviously affected suppliers are non-US OEMs, but ultimately the tariffs won’t spare any suppliers as the industry’s multi-lateral, multi-jurisdictional supply lines are simply too interwoven and complex. Manufacturers, suppliers and operators will already be hard at work on damage-limitation. Any such exercise is likely to be confounded by shifting rules and penalties. In the short-term the situation will probably deteriorate as other countries retaliate and tariff rates escalate. In the medium term, Trump will be hoping to induce trade negotiations which enable tariff reductions. In the longer term, part of the strategy is to onshore production and support facilities within the US.

All such outcomes are profoundly uncertain at the moment, and this perception will worry the industry above all; uncertainty most obviously unsettles the case for capital allocation, particularly for discretionary purchases like business jets. As they stand now, Trump’s tariffs also represent a significant tax on US consumers, which is bound to erode consumption, the mainstay of the US economy these last 5 years. Since Liberation Day, the S&P, Dow Jones and Nasdaq are all down 10% from their recent 2024 highs, wiping out over $5bn in shareholders’ value. Compounding the pain for business jet users and buyers, tariffs are bound to reassert inflationary pressures, just as central banks would want to soften interest rates.

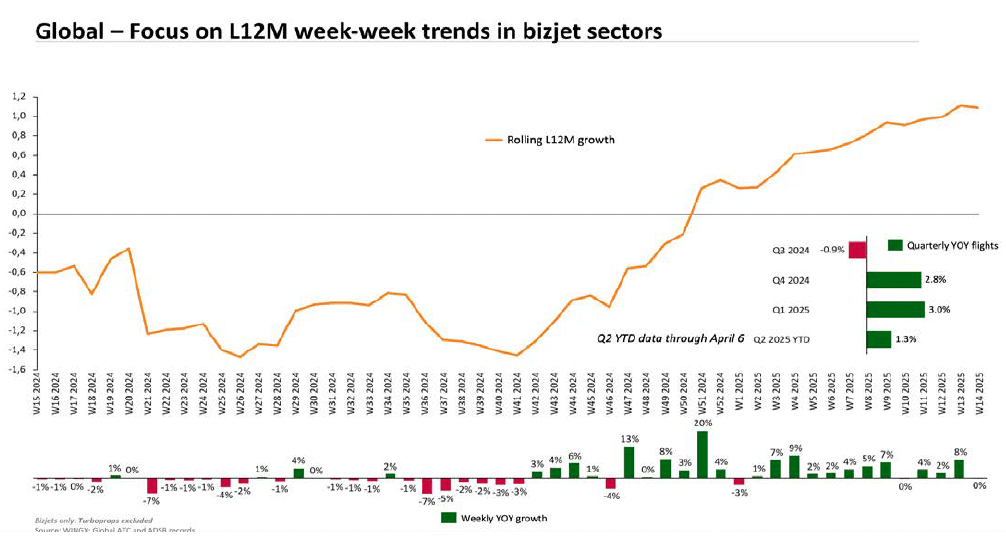

Despite the economic mayhem, customer confidence is so far apparently resilient in the bizjet industry, for now. The first quarter of 2025 showed a 3% increase in global business jet movements compared to same quarter 2024, maintaining more than 25% increase in market size, measured by flight activity, since 2019. The OEMs’ business jet order books are solid for the next two years, most recently buoyed by a record $7bn deal for Embraer from Flexjet in February. The OEMs will struggle to bring tariff costs retrospectively into preordered deals. But at least they may feel relatively assured that tariff turbulence will have calmed by the time their current purchasers get delivery in 2027. They may also get tariff exemptions, as it appears Bombardier will. So we may see industry market surveys, which have been resoundingly positive since Trump’s reelection, hold up for now.

At a more nuanced level, the tariff repercussions are likely to amplify trends already apparent in bizjet usage. Whilst overall flight activity has increased modestly in the last 12 months, there have been significant declines in many parts of the market, offset by strong gains in others. Older midsize aircraft platforms, and almost all light aircraft types have seen steady declines in activity. Corporate flight departments have cut back on their aircraft operations. European bizjet activity is stagnant, with recession-stricken economies like Germany generating significantly less flight demand than in 2019. Conversely, recently manufactured aircraft, particularly in super midsize and ultra long-range segments, are seeing double digit growth in activity. Outside Europe, bizjet demand has grown rapidly in regions as diverse as the Persian Gulf, Brazil, Florida and Singapore.

Business jet activity since Trump election

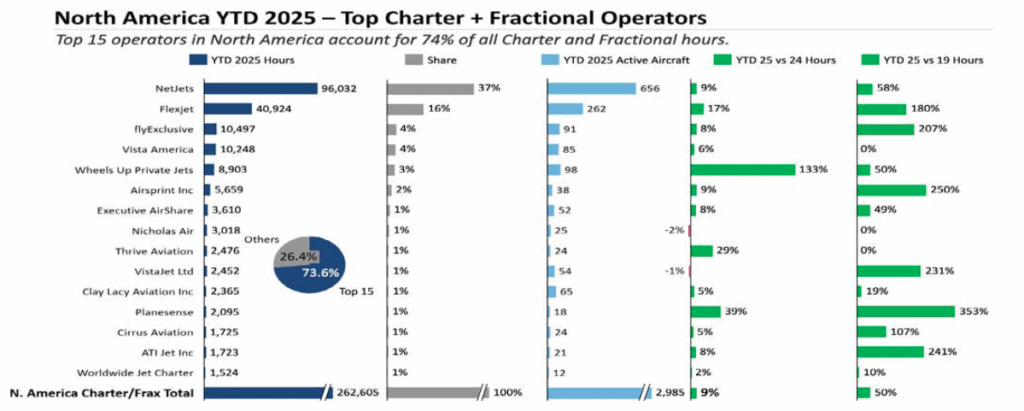

The most obvious outperformer in terms of generating bizjet activity is the fractional operator, and more broadly, the large fleet operators offering customers predefined program access. These operators – notably NetJets, Flexjet and Vista Global – have made outsized gains in market share since 2019. For any would-be purchaser, the incoming tariffs are surely a disincentive to owning an aircraft, which may further tilt the shift towards asset-light access options. The tariff costs won’t disappear, and ultimately the user may pay their part, whether as an owner or charter passenger. But the escalating complexity of asset ownership may show up in fewer buyers and more renters.

Fractional and Charter operator activity

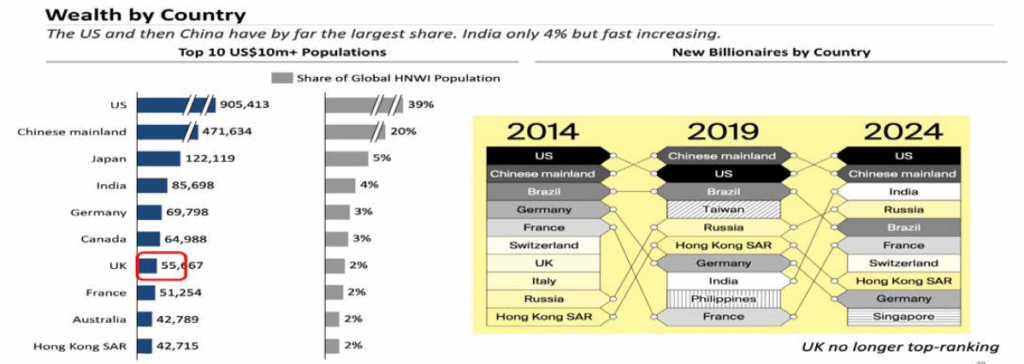

As bizjet fliers shift towards newer aircraft on operator programs, the ageing older fleet will get less and less usage. The pressure to retire older aircraft has been building as maintenance costs have risen and more environmental mandates come into force. This will surely now be accelerated as tariffs inflate costs across the supply chain of replacement and upgrade parts and servicing. Last year both Vista Jet and Fly Exclusive shed their older aircraft in favour of new models. Without a business case for retaining these aircraft, they will be increasingly parked and scrapped. Reductions in the viable stock of aircraft in the charter market may help absorb the slower economy’s impact on charter demand. As suppliers and operators prepare to navigate the tariff storm, we will likely see a slowdown in a relatively strong business jet cycle since the pandemic. But in the longer term, they should be confident in changes which favour industry growth. Unintentionally, the US economy may suffer most in the short term from tariffs. Whereas tariffs, and the broader geopolitical realignment around them, may be a shock which galvanises new trading relationships and industrial investment in other regions. Bizjet OEMs may now choose to double down on emerging markets. Emerging markets will have a bumpy ride in the near-term, but longer-term, these regions will generate the lions’ share of new wealth-generation.

Wealth Generation By Region

The cyclical ups and downs of this industry have always been punctuated by external shocks – 911, GFC, Covid – and the tariff spree of 2025 may be the next on the list. The supply-side ramifications hopefully won’t be as dramatic as Covid, but they may in similar ways require industry players to fundamentally rethink their operating model. In the short term the impact looks negative, although a down market tends to create opportunities for best-positioned incumbents, with program operators seemingly well positioned. The tariff shock certainly won’t give the industry the silver lining it got from the pandemic, but neither should it forestall the longer-term opportunities for this business as it spreads its wings to new regions and new generations of users.